Elie Tahari pays $7.8M to Penn South Capital for 10-unit walkup in Alphabet City October 5, 2023 7:

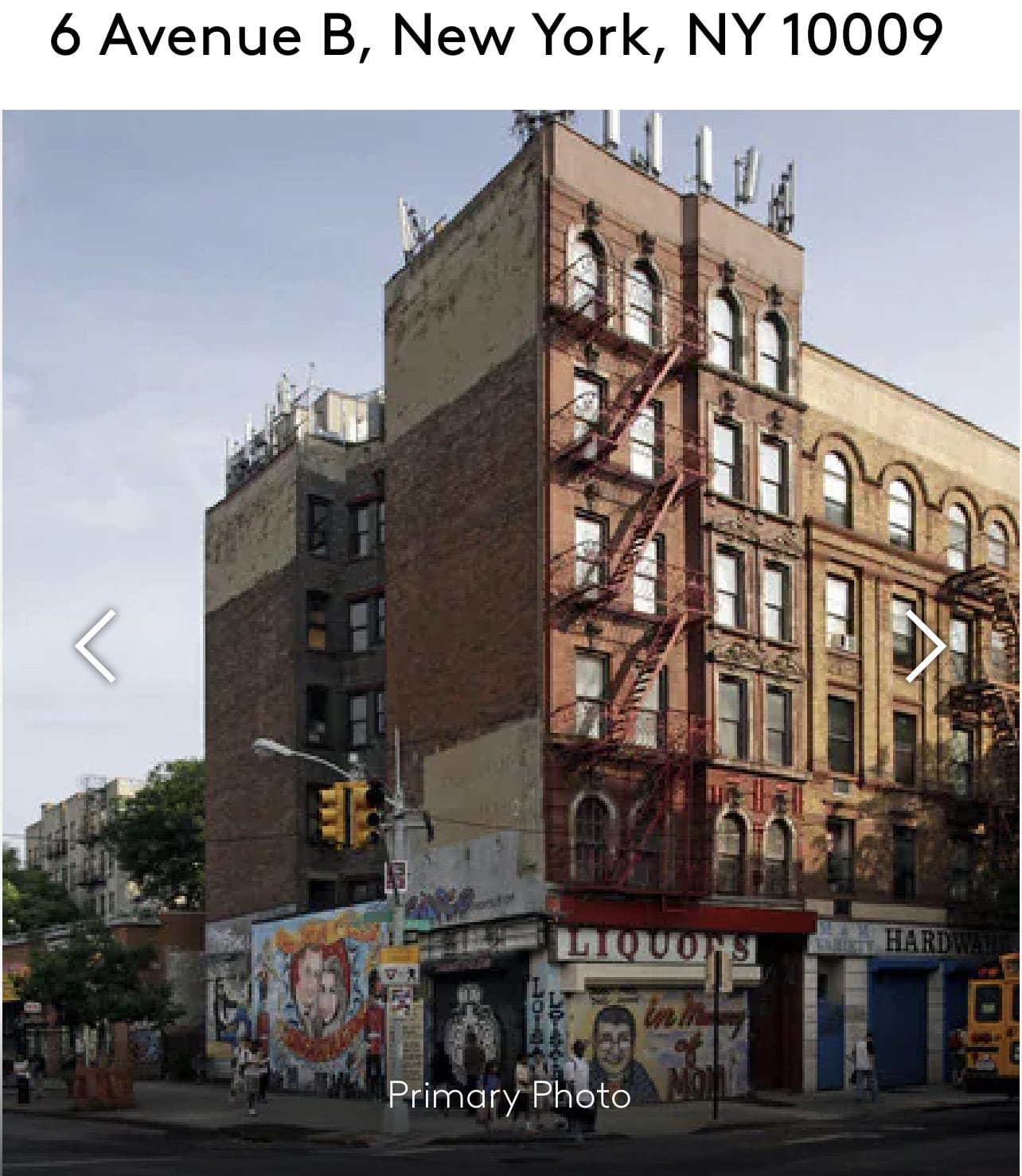

Fashion designer Elie Tahari through the entity 6 Avenue B LLC paid $7.8 million to Parag Sawhney’s Penn South Capital through the entity Grogu Holdings LLC for the 10-unit residential walkup building (C7) at 6 Avenue B in Alphabet City, Manhattan.

The deal closed on September 29, 2023 and was recorded on October 4, 2023. The property has 7,995 square feet of built space and 2,945 square feet of additional air rights for a total buildable of 10,944 square feet according to a PincusCo analysis of city data. The sale price per built square foot is $975 and the price per buildable square foot is $712 per the PincusCo analysis. (The price per square foot analysis is the transaction price divided by square feet as reported in public records and assumes no air rights have been sold.)

The seller bought the property on January 27, 2023, for $5.2 million in a transaction that had two parts. The signatory for Penn South Capital was David Goldoff of Camelot Realty Group. The signatory for Elie Tahari was Elie Tahari. The contract date was September 28, 2023.

Prior sales and revenue

Prior to this transaction, PincusCo has no record that the buyer Elie Tahari had purchased any other properties and has no record it sold any properties over the past 24 months.

The seller Penn South Capital purchased 13 properties in 12 transactions for a total of $72.6 million and sold two properties in two transactions for a total of $9.5 million over the same time period. The former owners according to the Department of Housing Preservation and Development includes Parag Sawhney, individual owner and Luis Rosales, site manager.

The property

The residential walkup building with 10 residential units in Alphabet City has 7,995 square feet of built space and 2,945 square feet of additional air rights for a total buildable of 10,944 square feet according to a PincusCo analysis of city data. The parcel has frontage of 24 feet and is 79 feet deep with a total lot size of 1,818 square feet. The lot is irregular. The zoning is R8A which allows for up to 6.02 times floor area ratio (FAR) for residential with inclusionary housing. The city-designated market value for the property in 2022 is $2.7 million. The most recent loan totaled $5.8 million and was provided by Emerald Creek Capital on January 27, 2023.

Violations and lawsuits

There were no lawsuits or bankruptcies filed against the property for the past 24 months. In addition, according to city public data, the property has received five DOB violations, $4 million in ECB penalties, and $40,680 in OATH penalties in the last year.

Development

There are no active new building construction projects or major alteration projects with initial costs more than $1 million on this tax lot.

The block

On this tax block, PincusCo has identified the owners of four of the 11 commercial properties representing 45,735 square feet of the 210,130 square feet. The largest owner is Penn South Capital, followed by Kushner Companies and then Better Living Properties.

On the tax block, there were three new building construction projects totaling 205,593 square feet. The largest is a 67-unit, 68,531 square-foot residential (R-2) building submitted by Daniel Hirsch and filed by Daniel Hirsch with plans filed December 23, 2021 and permitted May 2, 2022. The second largest is a 67-unit, 68,531 square-foot residential (R-2) building submitted by Daniel Hirsch and Tamar Olitsky and filed by Daniel Hirsch with plans filed December 23, 2021 and permitted May 2, 2022.

The majority, or 55 percent of the 210,130 square feet of built space are elevator buildings, with walkup buildings next occupying 35 percent of the space.

The seller

The PincusCo database currently indicates that Penn South Capital owned at least 16 commercial properties with 108 residential units in New York City with 95,133 square feet and a city-determined market value of $50.6 million. (Market value is typically about 50% of actual value.) The portfolio has $98.1 million in debt, with top three lenders as KeyBank, Shelter Growth Capital Partners, and Midcap Financial respectively. Within the portfolio, the bulk, or 63 percent of the 95,133 square feet of built space are walkup properties, with mixed-use properties next occupying 10 percent of the space. The bulk, or 88 percent of the built space, is in Manhattan, with Brooklyn next at 12 percent of the space.

Direct link to Acris document. link

Recent Comments